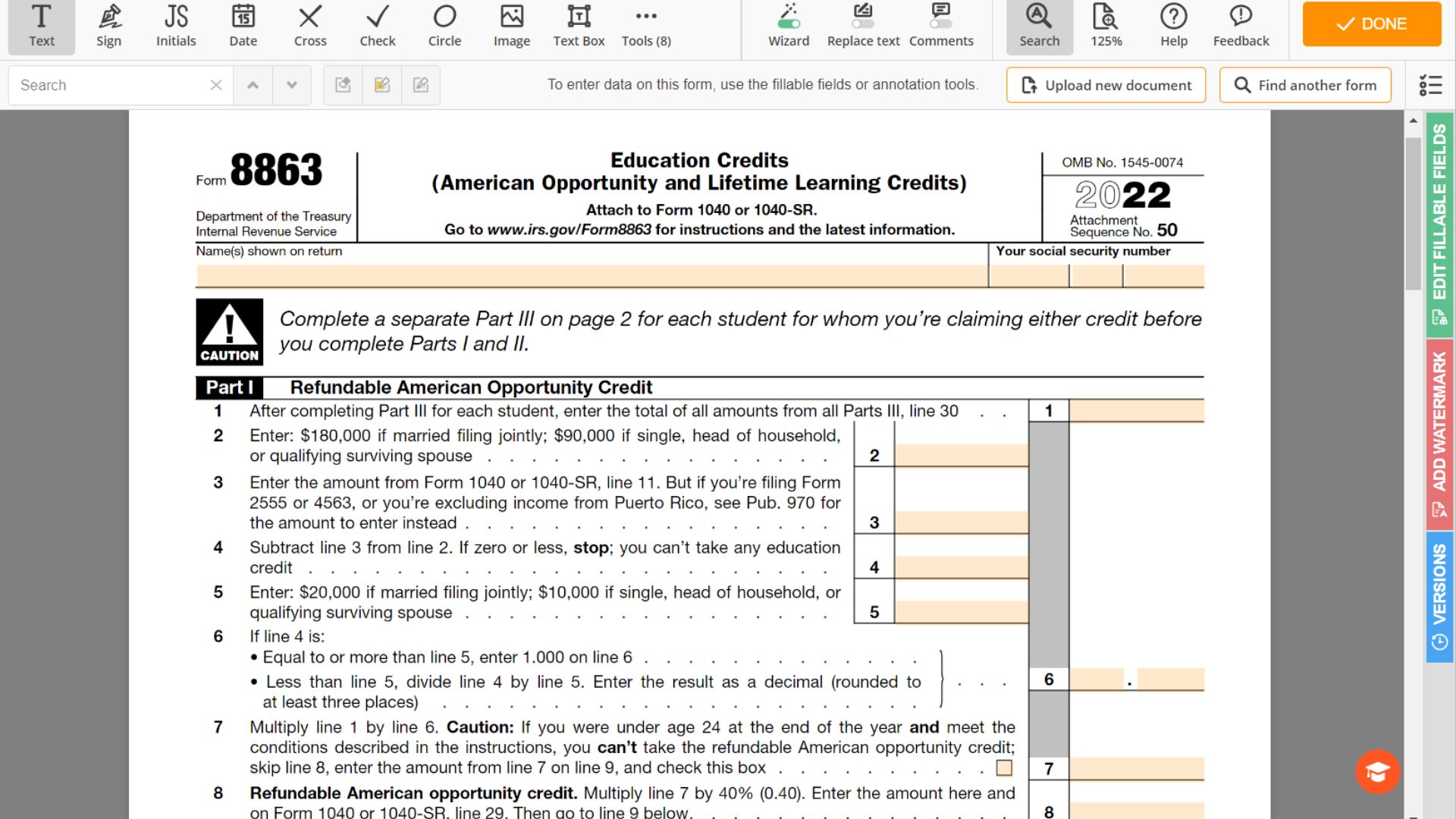

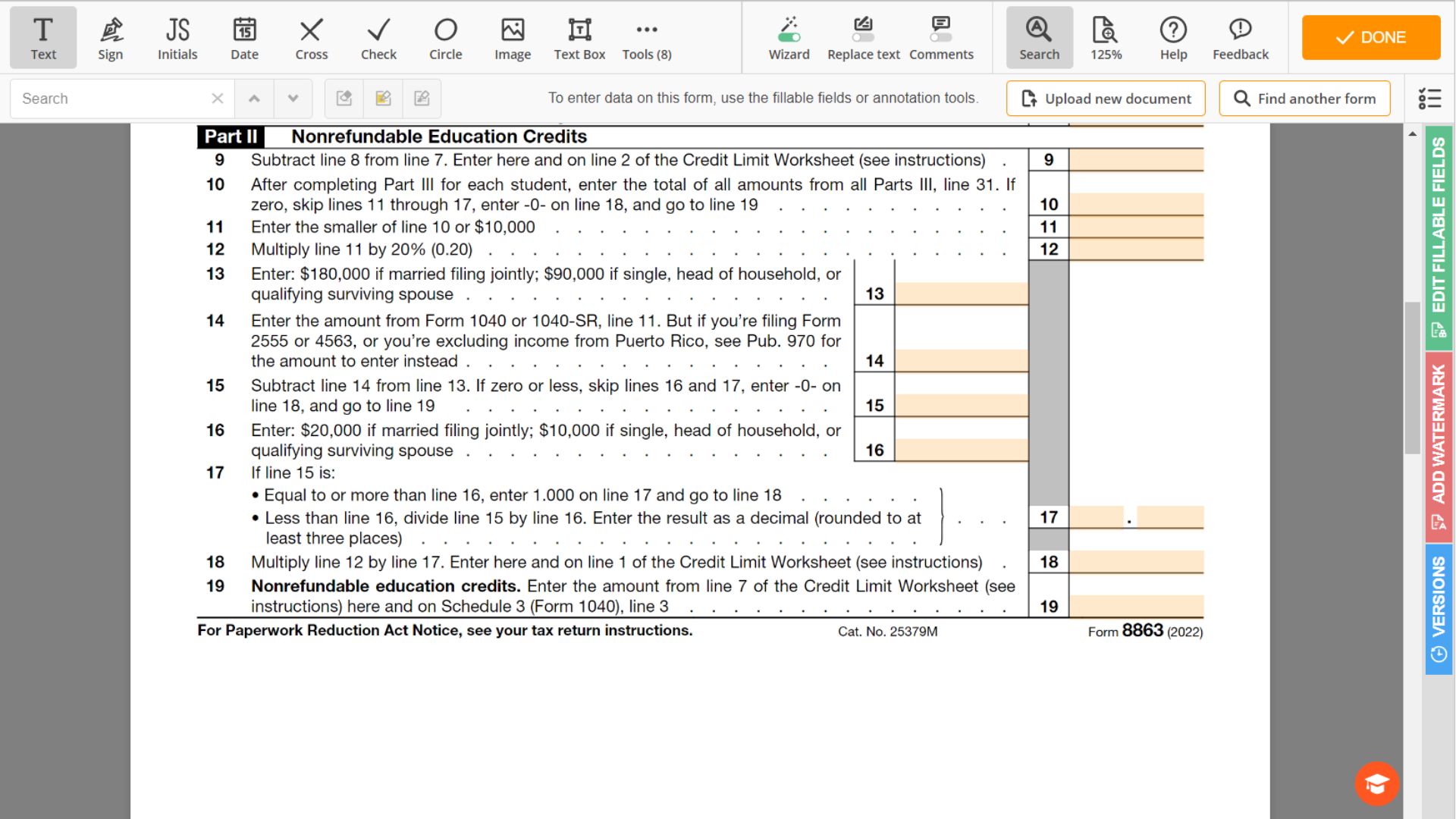

This is a vital document individuals use to claim education tax credits. Education credit form 8863 applies to taxpayers who have paid qualifying educational expenses such as tuition fees, books, and other required materials. It provides an option to claim the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC), which helps taxpayers reduce their tax liability.

Our website 8863-form.com is a valuable resource for individuals who need help filling out the document. The website offers detailed Form 8863 instructions, PDF examples, and tips on how to complete the template accurately. Additionally, the website provides information on eligibility criteria for both credits and helps taxpayers understand which credit is most suitable for their situation. The site also includes a downloadable PDF version, making it easy for taxpayers to access and print the credit limit worksheet of Form 8863. Overall, 8863-form.com is an excellent resource for individuals who need assistance in filing their taxes and claiming education credits.

IRS Form 8863: Maximizing Your Education Tax Credits

It must be filed by individuals who want to claim education tax credits. Suppose you've paid for qualified educational expenses such as teaching fees, thematic books, and other required materials. In that case, you can claim either the AOTC or the LLC. To claim these credits, you must fill out the 8863 tax form: printable or online, and include it with your federal return.

Exemptions for filling and filing the credit limit worksheet 8863 include the following:

- If you're a nonresident alien.

- If you're claimed as a dependent on someone else's tax return.

- If your modified adjusted gross income (MAGI) is above a certain threshold.

You can use a blank, printable template available on the IRS website or other online document preparation software to fill out the document. You can also find federal tax form 8863 instructions, examples, and a PDF sample on our website. Ensure you follow the instructions carefully to claim the correct education credit.

The Complete Guide to Filing 8863 Tax Form

Filling and filing the template can be confusing, but claiming education tax credits is essential. Here's a step-by-step guide to help you:

- Ensure you can claim the education tax credit before filling out Form 8863 PDF.

- Collect all the records of your qualified educational expenses.

- You can get a blank, printable template from the IRS website or other SPECIFIC preparation software.

- Read the IRS Form 8863 for 2022 instructions before filling out the sample. Ensure you understand the eligibility criteria, tax credit options, and the sections you must complete.

- Fill out the template accurately, providing all the required information, including your name, address, Social Security Number, and education expenses.

- Double-check all the information you've provided to ensure accuracy.

- Include your completed Form 8863 example with your federal tax return.

- Make a copy of your completed sample for your records

- Submit your tax return, including Federal Form 8863, either online or by mail.

Remember, the eligibility criteria and tax credit options may change yearly. Therefore, it's essential to check for the latest IRS 8863 Form instructions, sample PDFs, and blank templates before filling out and filing the copy.

Form 8863 & Credit Limit Worksheet Instructions

- What is the document about, and who needs to file it?

It's generally used to claim education tax credits. Individuals who have paid qualifying educational expenses, including tuition fees and books, may be eligible to claim either the American Opportunity Tax Credit or the Lifetime Learning Credit. To claim these credits, taxpayers must fill out the 8863 form and include it with their federal tax return. - Where can I find a printable template?

You can find a blank sample of Form 8863 on our website or other online tax preparation software. Additionally, the IRS website provides instructions, examples, and a sample PDF of the form to help taxpayers fill it out accurately. - How do I know if I'm eligible to claim education tax credits using Form 8863 for 2022?

To determine your eligibility, check the IRS guidelines for education tax credits. The eligibility criteria may change from year to year, so make sure to read the latest instructions and guidelines before filling out the document. - What exemptions are available for filling and filing the 8863 tax form for 2022?

Exemptions for filing include not claiming any education tax credits, being a nonresident alien, being claimed as a dependent on the tax return of someone else, having a modified adjusted gross income (MAGI) above a certain threshold, and filing a tax return for a year before 2022 or after 2023. - Can I file Form 8863 online?

Yes, taxpayers can use online samples to sign via special software to file their declarations. Alternatively, they can print out the completed form and submit it to the IRS.

IRS Form 8863 - Instruction for 2023

IRS Form 8863 - Instruction for 2023

Printable 8863 Form for 2022

Printable 8863 Form for 2022

Form 8863 Sample

Form 8863 Sample

Credit Limit Worksheet (Form 8863)

Credit Limit Worksheet (Form 8863)

Federal Tax Form 8863 Instructions

Federal Tax Form 8863 Instructions